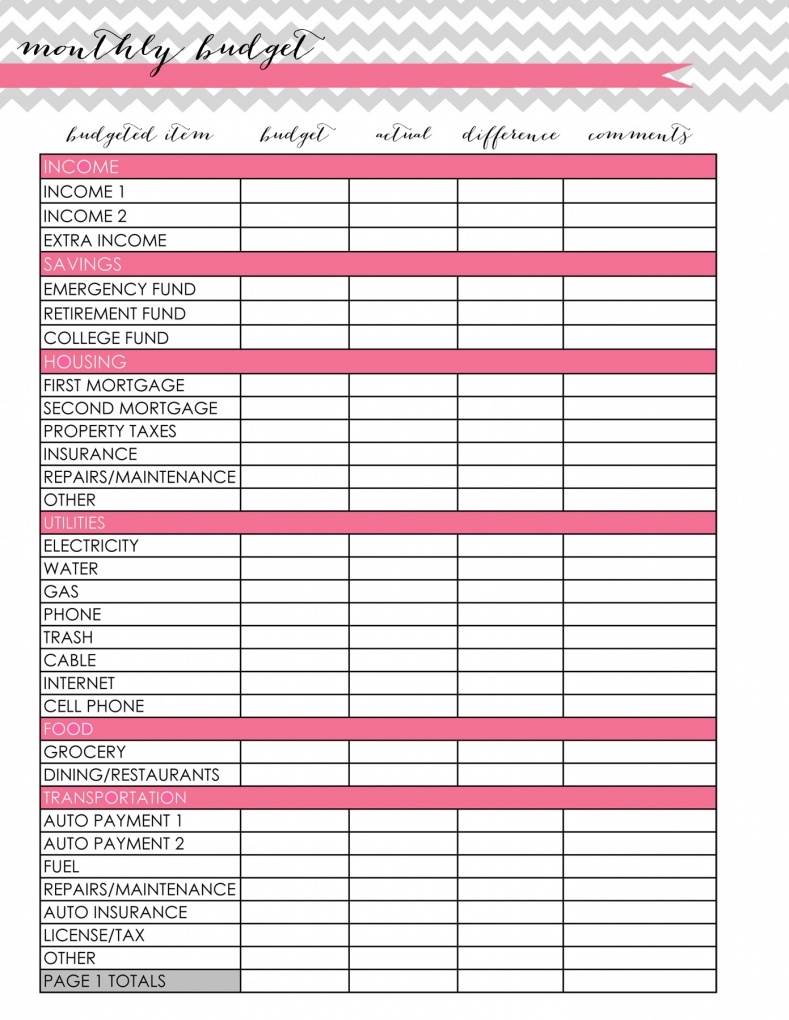

Yes, I am starting the list with my free budget planner I created for you. So if it is hard at first, don’t give up! 10 Free Printable Monthly Budget Templates to transform your finances Free Printable Budget Planner from Savvy Frugal Mom The more you work on your budget, the easier it will get. Once you have your budget filled out, put it where you will see it and can refer to it often-planner, vision board, on the fridge, on the mirror. Compare your total income to your total expenses and savings goals. Fill in your monthly bills (all your bills, including debt payments)ĥ. Print out the free printable template of your choiceģ. I promised you using a budgeting printable would be easy. Plus, physically writing things down make them stick better in your brain. But when just starting out, nothing beats seeing your finances in front of you in black and white.

Using online templates or an excel budget are great once you get a better handle on your finances. When you are just getting started on budgeting, I always suggest start with pen and paper. Using a template allows you to really “see” your money-what you have coming in and where it is going out. Templates also help you to keep track of your income, expenses, debt payments and savings goals. You literally fill in the blanks on the page and watch your budget come to life.

Free printable budget sheet how to#

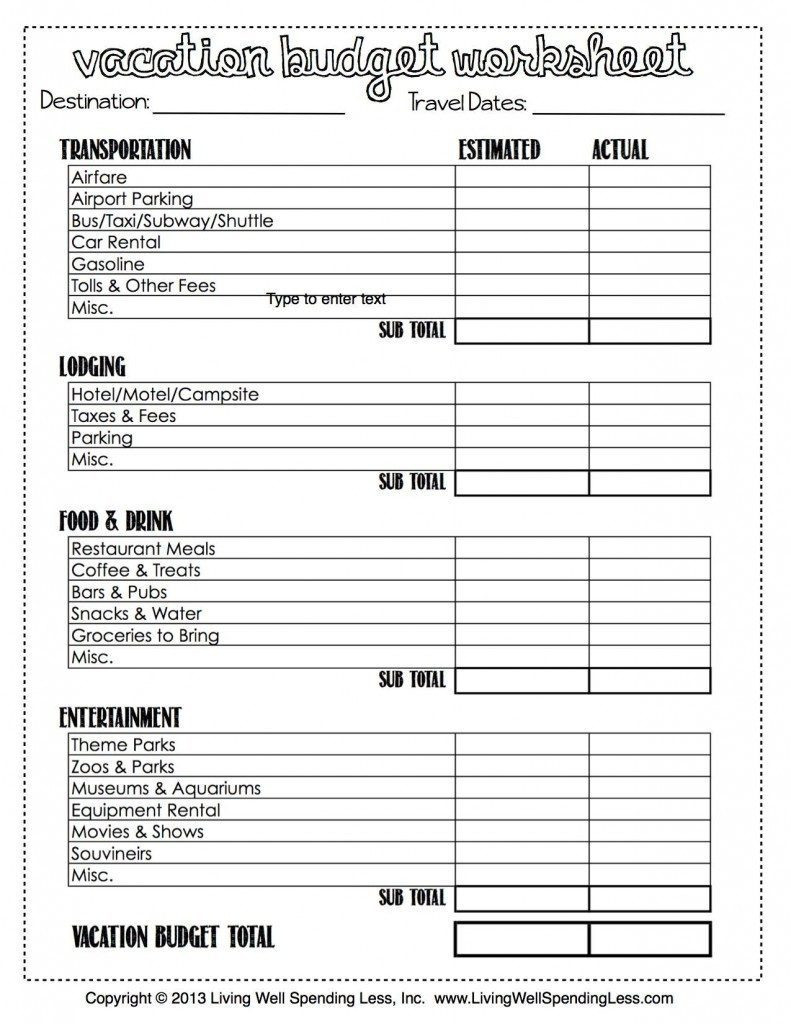

RELATED ARTICLE: How to use a Budget CalendarĪ budget template is a simple worksheet that you print out and then use to create the budget for your family. If you need help getting started with your budget, here are some great resources! And it just gives me one less thing to worry about! It helps us to stay organized and better understand where our money is going. We still use a budget template for our personal finances each and every month. That is why I went on a search to find you some great FREE resources in the form of free budgeting templates. Then a budget is what you need! And creating a budget is super easy when you use a printable budget template.Īnytime we can make life a little easier, I am all for it! Our printable has room to track those things too! If those goals are built into our budget (and bonus– automated transfers from our bank account), we will be able to pay down our debt and build up our savings much faster.Free Printable Budget Worksheets to help you get startedĪre you ready to take control of your finances? Are you ready to stop wondering where your money went and start making progress on your financial goals? Step 4- Set goals for saving and paying down debt on the free printable budget worksheets.Īlong with paying our bills and managing our variable expenses, we’ll often want to put money each month toward paying down debt more aggressively or making progress toward big savings goals like a vacation fund, holiday fund, retirement, college savings, and more. We will only feel defeated if we set our numbers so low that we can’t possibly reach them and find ourselves overspending each month. It’s important to be realistic when setting budgeting goals for our variable expenses categories.

You can grab our cash envelopes or variable expense tracking sheets in our free printable Budget Binder to help with that. It may be helpful to keep a record of our variable expenses throughout the month to make sure we’re staying within our budgeted amount. To get an idea of how much we should budget for each of these categories, again, we can look at past bank statements. Variable expenses can get a little trickier because they can fluctuate quite a bit. Recurring expenses are pretty straightforward because they are mostly the same every month. To figure out how much to budget for each item, look at your past bank statements to get an idea of how much you’ll owe.

Utilities (gas, water, electric, sewer, etc.)Īnything that has the same general payment each month can go in the recurring category.Some of the items in the recurring expenses section may be: Recurring expenses are our bills, payments that are generally the same every month. But if you happen to have a great month and net $1000 from your side hustle instead, you would write that in the “Actual” column and note the difference of +$500. So let’s say you have a side hustle that generally nets $500 per month. In the income section, as well as the other sections of this worksheet, there is a spot to write the budgeted amount as well as the actual amount.

0 kommentar(er)

0 kommentar(er)